Factor liquidity sleeve (using ETFs)

Part 3/10: FACTOR LIQUIDITY SLEEVE (USING ETFS)

Client level of adoption/allocation:

In our previous articles we discussed why it’s important to use factor investing to understand where the performance in your portfolio comes from and also how to use portfolio completion to compensate for any tilts or gaps that your portfolio might have.

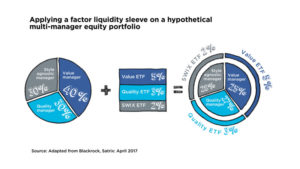

In this article, the third in our series, we discuss how factor investing can be used to enhance the trading flexibility of a portfolio through the use of ETFs (exchange traded funds) [See Figure 1]. Specifically, we focus on the practical application of building a liquidity sleeve around your portfolio to aid liquidity management in the following scenarios:

1) if the portfolio needs to quickly change its style exposure

2) when the portfolio has large and frequent cash flows in and out of the fund

3) during a period of market stress.

Essentially, constructing a ‘liquidity sleeve’ involves building a portfolio of ETFs around your existing active managers to provide similar market exposure, but with additional liquidity to absorb unexpected changes in the portfolio when needed.

Figure 1: Applying a factor liquidity sleeve on a hypothetical multi-manager equity porfolio

Change style quickly

Using factor ETFs to quickly realign the style exposures of a portfolio can be a useful tool. If you made a decision to change the overall factor exposure of the portfolio, shifting allocations between underlying managers is an option. However, should it be necessary to introduce a new manager, using an ETF to swiftly attain that exposure would mitigate the often lengthy process of manager selection and due diligence.

In addition, in the scenario that an underlying active manager experiences style drift (a change in factor exposure because it’s straying from its self-stated investment objective), the portfolio is at risk of becoming misaligned. Temporarily using an ETF to realign factor exposures would make sense in this case.

Manage large cash flows

If a portfolio experiences large and frequent cash flows in and out of the fund, the fund could incur additional transaction costs if the portfolio rebalances by directly trading the individual securities. If any of the underlying funds hold shares with smaller market capitalisations, acute liquidity problems could arise, including low volume and high bid/offer spreads. This in turn could lead to either delayed trading, a noticeable market impact (moving the price of the assets in an unfavourable direction) or opportunity costs incurred in the fund. Trading in ETFs when dealing with these cash flows is often cheaper than directly trading the underlying securities, as the ETF bid/offer spread can be tighter than on the underlying securities.

Move nimbly under market stress

While ETF prices do fluctuate in line with tough conditions in the market, they have become an important tool that allow investors to observe market movements in real-time, and to transact even when markets are stressed. During these periods, uncertainty could cause many investors to sell shares at the same time, and prices may move sharply in a single day. As prices in the equity market fall quickly, so too will the price of an ETF, reflecting the changing value of the securities it holds. However, because a share and an ETF trade in distinctly different markets, an investor’s ability to quickly sell these two securities can be very different. In well-developed ETF markets, price improvement and the ability to trade during periods of market stress can be hugely beneficial during a period where the liquidity of the underlying shares is low.

Comments are closed.