Sustainable

Infrastructure

Fund

Compelling Returns

Benefit from reasonably compelling financial outcomes that align with long-term liabilities

Private Market Opportunities

Access investment opportunities not readily available in the market

Positive Impact

Make a positive impact on the development of South Africa

Building a Legacy

There is something to be said for leaving a legacy. Building something that will then be used for generations to come. Helping create tangible assets that are useful and sustainable. Guiding people along a path and instituting bridges over the obstacles they might face.

With the right people and the right partners, we can create a legacy plan for South Africa. A tangible plan, built from roads, bridges, renewable energy, healthcare, communication, water and waste-related assets.

Infrastructure Solution

Ockert Doyer, Portfolio Manager of the Infrastructure Solution talks about the asset class and nuances of the Fund.

Investment Strategy

We predominantly invest in senior or subordinated debt across a broad spectrum of South African infrastructure assets, with the ability to invest up to 10% in equity. Strict ESG criteria are applied to all potential investments to support sustainable investments.

Infrastructure Investments

Investment Approach

Sanlam is uniquely positioned as an infrastructure investor with a long track record, originating over six billion rand in assets. Investors benefit from our dedicated deal origination and assessment teams, and access to a wide spectrum of deal flow in this essential part of the local economy.

Immediate access to diversified assets

Deal originators with 30 years’ experience

Strong governance and deal assessment processes

ESG and impact measuring and reporting

Immediate access to diversified assets

Deal originators with 30 years' experience

Strong governance and deal assessment processes

ESG and impact measuring and reporting

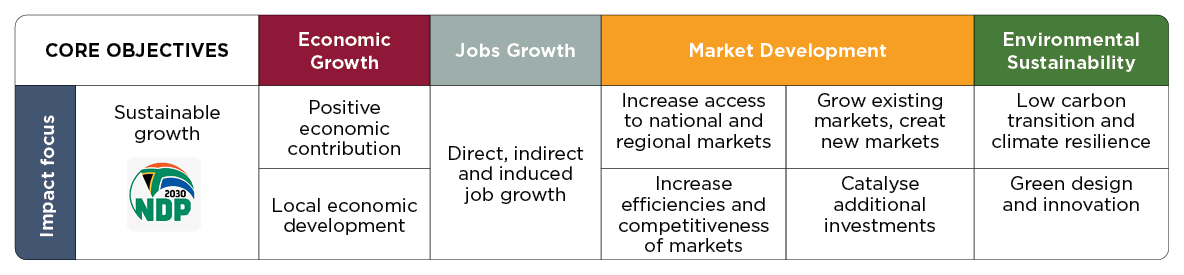

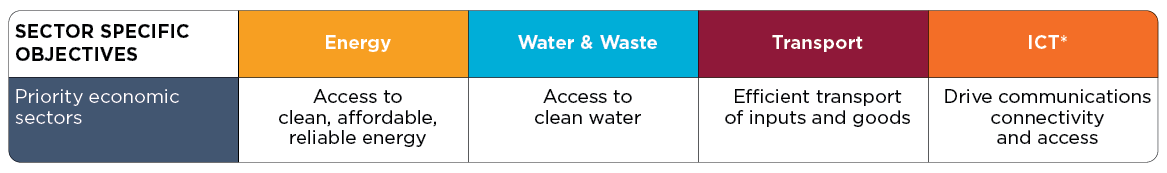

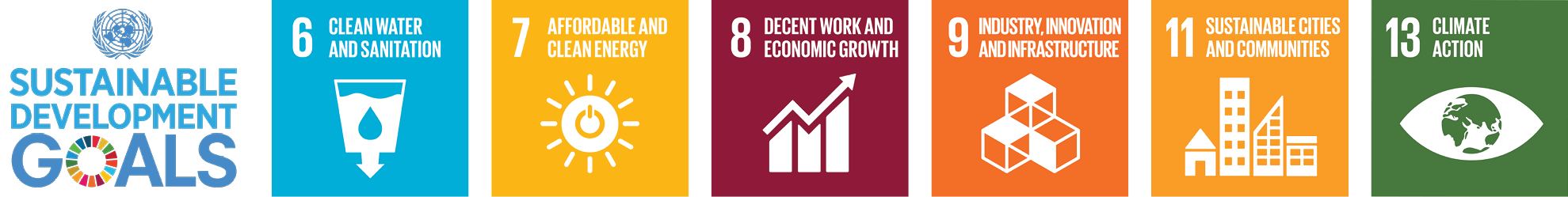

Impact Approach

Investment Process

Deal origination

- Proprietary

- Broker Network

- Banks

Risk assessment

- Quantattive process

- Qualititative process

- Issuer and issue ratings

Credit vetting

- Credit Sub-Comittee

- Central Credit Commitee

Investment decision

- Investment & Impact Committee

- Impact and ESG assessment

- Investment decision

Monitoring

- Ratings using bespoke system

- Monitoring of limits by Compliance unit

Through infrastructure investing, we can build a legacy of sustainable positive impact.

Our Team

The team consists of two infrastructure portfolio managers and specialist infrastructure financiers with substantial experience in assessing infrastructure assets. We have a dedicated infrastructure origination function and deal assessment team and we leverage off the legal, compliance and operational functions of the broader Sanlam Investments Group.

OCKERT DOYER

Portfolio Manager

PAWAN SINGH

Co-Portfolio Manager

MAMOEKENG MATLAILA

Infrastructure Financier